Global pandemic impact

The extended bull run came to an abrupt end in March as the coronavirus continued to spread into Europe and America, and a collapse in confidence pushed share indices into bear-market territory. Investors suffered exceptionally high levels of volatility during the month as share prices plunged and the price of oil plummeted.

- Equity markets experienced double-digit losses over March and Q1

- Lockdown measures fuelled concerns about the growth outlook

- Central banks around the world cut interest rates

The effects on financial markets

The FTSE 100 Index fell by 13.8% over the month and by 24.8% over the first quarter. In comparison, the Dow Jones Industrial Average Index dropped by 13.7% in March, and by 23.2% since the start of the year. Germany’s benchmark Dax Index posted a monthly decline of 16.4% and a quarterly decline of 25%, and Japan’s Nikkei 225 Index fell by 10.5% over March and by 20% over the first three months of the year.

The World Health Organisation (WHO) upgraded the coronavirus outbreak to “pandemic” status early in March. By the end of the month, over three-quarters of a million cases of Covid-19 had been diagnosed, with over 36,000 deaths recorded.

In a bid to stem the spread of the virus, governments imposed stringent lockdowns and quarantining measures. Companies were shut down, travel was restricted, and people were directed to stay at home. Business ground to a halt, fuelling concerns over the impact on economic growth. The International Monetary Fund (IMF) warned that “under any scenario, global growth in 2020 will drop below last year’s level”. Meanwhile, the Organisation for Economic Co-operation & Development (OECD) believes that the shutdowns will directly affect sectors equating to as much as one-third of GDP in major economies.

Governments around the world announced measures to support businesses and households against the impact of the pandemic. In particular the UK Government announced a range of measures designed to support the UK economy, workers, and households, while the US Senate passed a coronavirus aid bill worth US$2 trillion. Elsewhere, major central banks loosened monetary policy, cutting interest rates and extending asset purchases to support the economy. The Bank of England (BoE) carried out two emergency interest-rate cuts, slashing its key interest rate to an all-time low of 0.1%. The US Federal Reserve (Fed) reducing its federal funds rate to a range of zero to 0.25%. Central banks including Canada, Malaysia, India, and Australia also implemented rate reductions.

What lies ahead

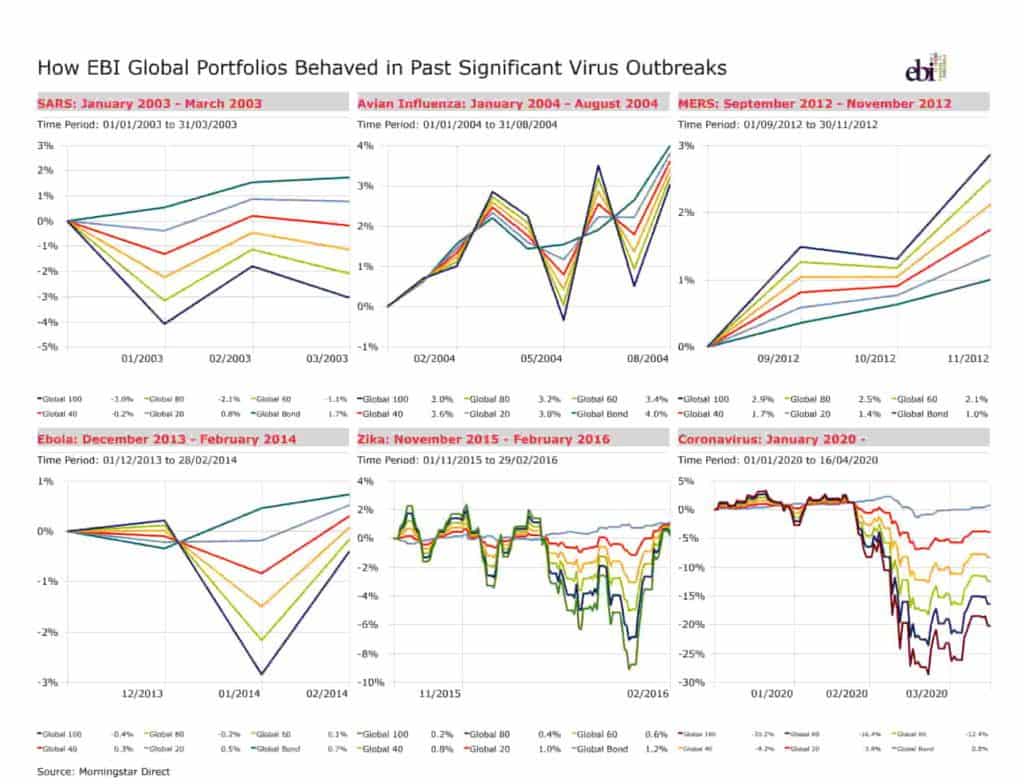

In these unprecedented times investors need to look towards the benefits of investing for the long term. The graphs below shows how markets have recovered for different Pandemics, although the Global Impact from a monetary perspective is not known and there is the likelihood of a global recession. Markets do recover and I would encourage investors to look at the long term benefits of investing rather than the current level of extreme volatility markets are currently experiencing.

[simple-author-box]