Hi All

There is some uncertainty and volatility in markets at present so we thought you would appreciate a quick update on where we stand.

What is happening?

The story of the second half of 2021 and 2022 so far has been inflation. Extraordinary consumer demand (fuelled by supportive monetary policy in the form of low rates and quantitative easing by central banks; as well as generous fiscal policy in the form of furlough payments, business loans and tax relief, and unemployment support) has been meeting constrained supply (not enough raw materials, low inventory levels and supply chain issues). These have combined to drive inflation higher than expected – annual inflation reached 5.4% in the UK for December and was even higher for the US at 7% over the same period.

Central banks, who are tasked with controlling inflation, are now being forced to tighten monetary policy sooner and more aggressively than expected. Bond markets have been pricing in a faster end to quantitative easing and more rate rises than previously anticipated and this is what is causing the current market jitters (markets are now pricing in 4-5 rate rises from the US Federal Reserve this year whereas they were pricing in only 1 for 2022 last October). Higher borrowing costs (which are the direct result of central bank tightening), make life more difficult for all companies, but the market movements are also being exacerbated by two additional features:

- High valuations: Certain regions and sectors got very expensive during the period of low interest rates and easy liquidity. This was particularly true of ‘growth’ equities – those companies where sales are rising very quickly, and to a slightly lesser extent true for ‘quality’ equities – those which are very profitable. Both growth and quality equities have performed extremely well over the last decade and flourished particularly in 2020 in the aftermath of COVID. Growth equities were often those with online/tech business models that flourished during and directly after lockdown, whilst quality companies were seen as being defensive and so also performed well during and directly after the corona crash. Arguably these equities got too expensive, and the regime shift towards higher inflation and interest rates has provided an excuse to correct this.

- Weakening fundamentals in previous high-fliers: Certain companies that benefitted from lockdowns are now starting to warn that they’re seeing weaker growth now that COVID appears to be becoming less serious. The share price of Peloton (maker of home exercise bikes) fell dramatically last week after it announced it was pausing production of new bikes and Netflix fell almost 22% last Friday after it warned on slowing subscriber growth.

How is this affecting markets?

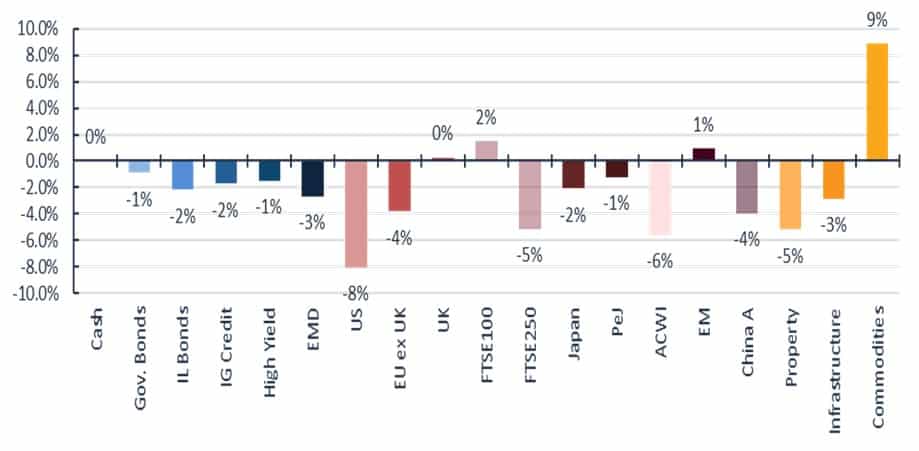

Asset Returns YTD

Most asset classes have fallen year to date. Bonds have fallen between 1 and 3% and Global equities as a whole (as measured by the MSCI All Country World Index or ACWI) are down almost 6% in sterling terms. US equities, traditionally seen as a more growth and quality-oriented index, are down 8% in sterling terms. In fact, if you look at growth equities specifically, they are down more than 11% year to date.

Cheaper equities, on the other hand, have outperformed dramatically year to date. The FTSE 100, a serial underperformer over the last decade and now one of the cheapest regional indices, has had a relatively good start to the year – up 1.5% year to date. Globally, value shares are down only 2% year to date, outperforming broader markets.

How is this affecting PortfolioMetrix portfolios?

PortfolioMetrix manages three main approaches here in the UK. Our biggest is our ‘unconstrained’ and hence most diversified, Core approach. As you would expect, this is down year to date as of last Friday but to a far lesser extent than global equities. These portfolios are down between 1% and 3.4% depending on risk level – relatively mild falls.

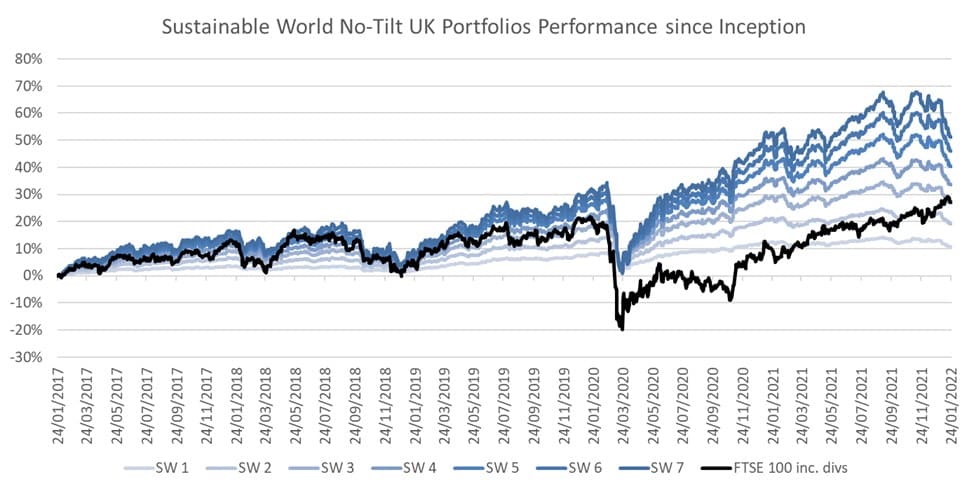

Sustainable World, our ESG Investment approach which aims to invest in companies that clearly benefit people and the planet, is unavoidably less diversified than Core. Because the cheaper shares today tend to be in more old-fashioned industries such as oil and gas, mining, airlines and banks, all of which Sustainable World avoids, it has a definite bias towards the quality/growth style. This style was helpful for the first 4 years of the approach’s existence, but it was a slight headwind for 2021 and has been a big headwind year to date. These portfolios are down between 2% and 8% year to date, depending on risk level – the riskiest portfolio having fallen slightly more than global equities (-6%), but less than pure growth equities (-11%).

The best performing PortfolioMetrix approach this year is Income Oriented. These portfolios are focused on income producing shares which are often those in more mature (and currently cheaper) industries. The approach thus has a definitive ‘value’ tilt which proved a headwind in 2020 when value sold off sharply, but has been very helpful this year. These portfolios are down less than 1% year to date.

What comes next?

Clients may be nervous given the start to the year, but further falls aren’t inevitable. Not all equity markets are expensive and PortfolioMetrix portfolios are tilted away from those that are. And the key to equity performance over the long-term remains how companies perform fundamentally – are they growing their sales and maintaining profit margins? The outlook here is positive – global economies are expected to grow faster than usual this year as are company earnings as a whole. This remains true for Sustainable World, despite its tough start to the year, given that it invests in companies which are looking to solve many of the world’s biggest problems and thus have huge potential (we note the approach hits its 5-year track record today which, despite this month’s weakness, remains very strong overall).

Bonds have already priced in an aggressive rate rising schedule (roughly 4 to 5 rate rises this year in the US, for example). They aren’t likely to produce massive returns from here, but they shouldn’t fall much further unless central banks are forced to act even more aggressively than currently expected. Moreover, bonds remain key to diversification – they do provide protection in the event of unexpected unpleasant events, which, as COVID showed us, do show up from time to time.

The markets remain fluid, but you can rest assured that we will continue to monitor them closely and act when and however necessary.

The information given here is for information purposes only and is not intended to constitute financial, legal, tax, investment or other professional advice. It should not be relied upon as such and PortfolioMetrix cannot accept any liability for loss for doing so. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. Past performance is not a reliable indicator of future performance. Portfolio holdings and asset allocation can change at any time without notice. PortfolioMetrix Asset Management Ltd is authorised and regulated by the Financial Conduct Authority.