In Brief

- Q4 2022 was generally positive for global markets, punctuated by the apparent reversal of specific trends

- Inflation appeared to top out in the US and, alongside it, the outperformance of the US dollar

- Central banks continued with their interest rate rises, but no more than already expected by bond markets.

- UK assets recovered after the debacle of the ‘mini-budget’, and the UK got a new prime minister.

- But continental European equities and the euro were the best performers after the continent’s success at avoiding energy blackouts, aided by an unseasonably warm winter.

Quarter Overview

October saw economies continuing to experience stubbornly high inflation, a rate hike from the European Central Bank and continued growth fears. Despite this, most markets ended the month positively in local currency terms, perhaps reflecting just how much bad news had already been priced. The biggest market-moving news was the continuing backlash from the UK mini-budget delivered at the end of September. This led to global bond market fragility and volatility in the first part of October, emergency intervention by the Bank of England (BoE) and senior ministers (including Prime Minister Liz Truss) losing their jobs. The BoE’s interventions and the swift announcement of Rishi Sunak as the new Prime Minister towards the end of the month settled UK bond markets, which in turn quietened global markets. This relief rally also caused sterling to strengthen for the month.

November saw markets breathe a sigh of relief. Primary developed market central banks delivered significant interest rate hikes as expected. Still, there were definite signs that inflation was moderating in the US, leading to hopes that the pace and size of these hikes would soon slow. Better news on the inflation front resulted in solid performance across equity and bond markets alike. There were also tentative signs of China relaxing its strict stance on COVID-19, which boosted Asian markets.

December delivered a partial retracement of November’s market bounce. As expected, major developed market central banks delivered 0.5% interest rate hikes, but communication accompanying the changes served as a reminder that inflation remains a threat. This dented the optimism of market participants – particularly in the US. However, China’s willingness to drop its zero COVID policy provided some welcome news to markets. Equity markets pulled back slightly across all regions, aside from China, with the concern of higher for longer rates hitting US companies, especially growth companies, harder than most. Bond markets also fell as rate expectations nudged up slightly.

Overall, the last quarter of the year saw a good performance from several previously beaten-down asset classes, particularly continental European equities. The dollar partially retraced some of its annual gains, contributing to the underperformance of US equities seen by overseas holders.

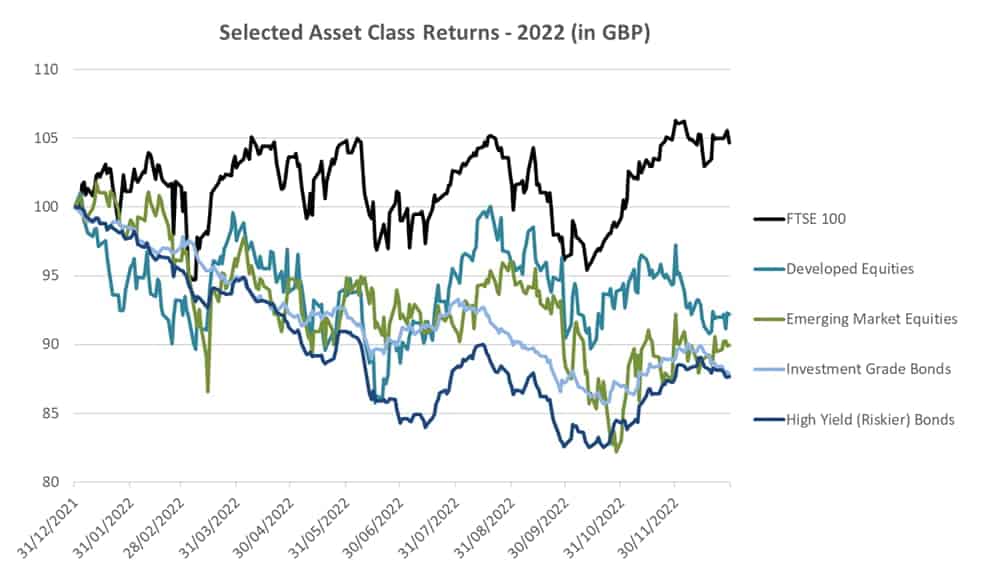

Volatility, as measured by the VIX index, fell over the quarter, although it remained up over the year. Developed market equities (as measured by the MSCI World Index, including dividends) rose 1.9% in sterling terms over Q4, held back by the pound’s recovery against the US dollar. The FTSE 100 rose 8.7% over the quarter, including dividends, and emerging market equities (MSCI EM Index) rose 1.8%. Global bond yields fell slightly over the quarter leading to higher quality bonds (as measured by the Bloomberg Global Aggregate Index) rising 0.7% (bond yields and prices move in opposite directions). Lower quality ‘high yield’ bonds also rose, up 5.9% as investors became slightly less worried about the strength of the global economy. After strong gains earlier in the year, oil fell 2.3% over Q4 whilst gold rose 9.8% (taking its year-to-date performance to flat for the year).

Data source: Financial Express

Indices used (including interest & dividends): Investment Grade Bonds – GBP hedged Bloomberg Global Aggregate Index; High Yield (Riskier) Bonds – GBP hedged Bloomberg Global High Yield Index, Developed Equities – MSCI World Index in GBP; Emerging Market Equities – MSCI Emerging Markets Index in GBP; FTSE 100 (UK Large Capitalisation Equities)

Diving into stylistic performance within indices, high-price securities (often described as ‘growth’) fell over the quarter, down 2.8%, while smaller companies were up 2.8%. Cheaper ‘value’ companies (which generally includes oil and gas and other commodity companies) relatively outperformed over the quarter, up 6.5%.

Data source: Financial Express

Indices used (including interest & dividends): Developed Equities – MSCI World Index in GBP; Growth (Expensive) Equities – MSCI The World Growth Index; Value Equities – MSCI World Value Index; Small Company Equities – MSCI World Small Cap Index

In terms of currencies, the pound had a mixed quarter. It rose 8.2% against the US dollar but fell 0.8% against the euro and 2.0% against the yen.

PORTFOLIO PERFORMANCE OVERVIEW

The PortfolioMetrix Core portfolios rose over the quarter, ahead of global equities. Asset allocation was favourable, with overweights to continental European Equities, UK and Japanese equities, and small relative underweight to underperforming US equities being helpful. An allocation to riskier bonds in lower-risk portfolios was also favourable. Active fund performance was broadly helpful over the quarter, particularly in continental Europe.

Sustainable World portfolios underperformed Core portfolios but were ahead of global equities overall, again with relative underweight to underperforming US equities contributing positively.

LOOKING FORWARD

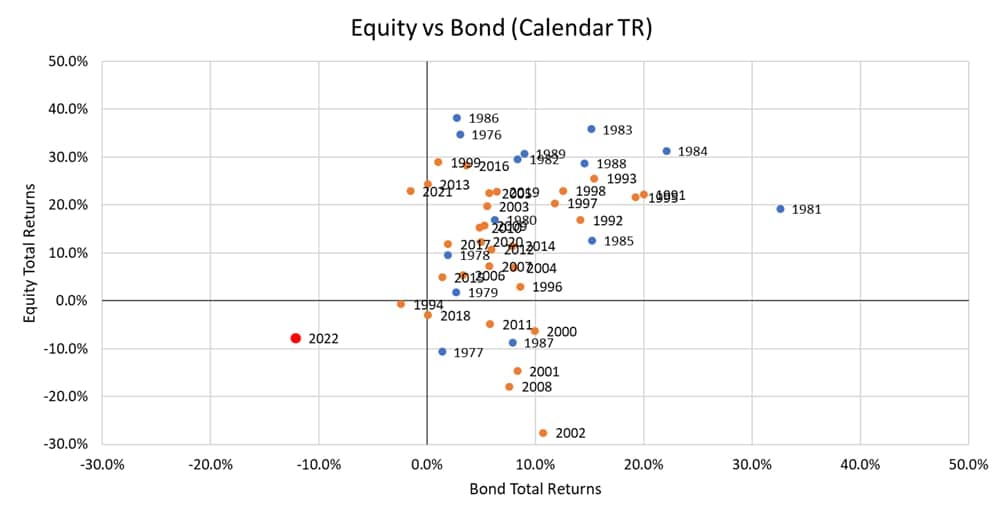

2022 was a tough year. Both equities and bonds, the two main asset classes available to investors, fell. And in the case of bonds, the falls were worse than anything experienced in the last almost 50 years.

Data Source: Financial Express. Equities: MSCI World Total Returns in GBP, Bonds: Bloomberg Barclays US Aggregate from 1976-1990 in USD as a proxy for currency hedged (Blue) and Bloomberg Barclays Global Aggregate Hedge GBP from 1991-2022 (Orange)

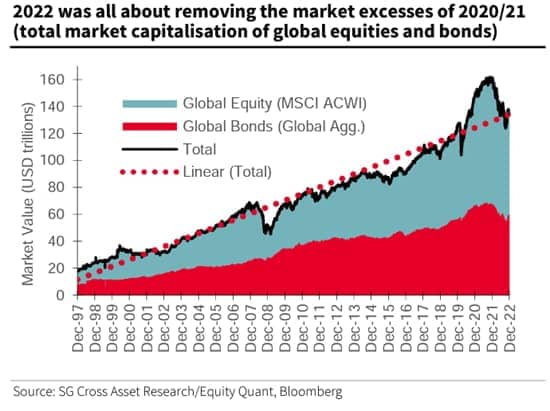

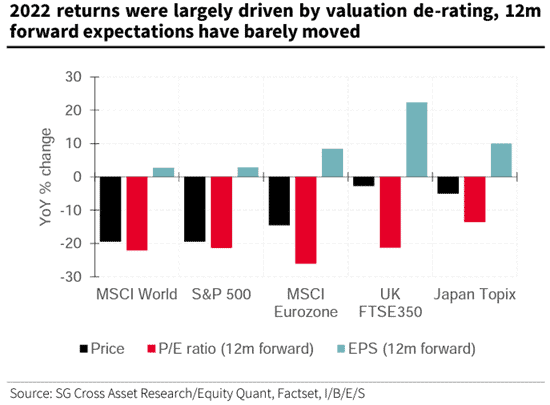

There is, however, room for more investment optimism as we start 2023. The biggest issue with 2022 was that both equities and bonds started the year highly priced, and so were vulnerable to any bad news, which duly arrived in the form of Russia’s invasion of Ukraine and central banks raising rates more than expected to try to tame inflation. After the falls of 2022, both equities and bonds are now much better value, with a lot of future bad news ‘priced in’.

Courtesy of John Authers Points of Return, Bloomberg, 4 January 2023

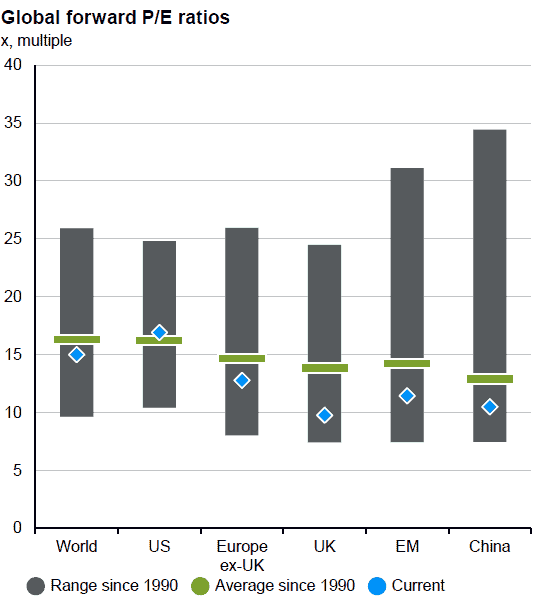

Equities now appear to offer decent value in most areas outside the US, and even US equities are just above long-term average valuations. There is a big question around whether company earnings, which didn’t fall in 2022, can continue to hold up in 2023, but equities now appear to offer value for long-term investors.

Source: J.P. Morgan Asset Management Guide to the Markets Q1 2023

Courtesy of John Authers Points of Return, Bloomberg, 4 January 2023

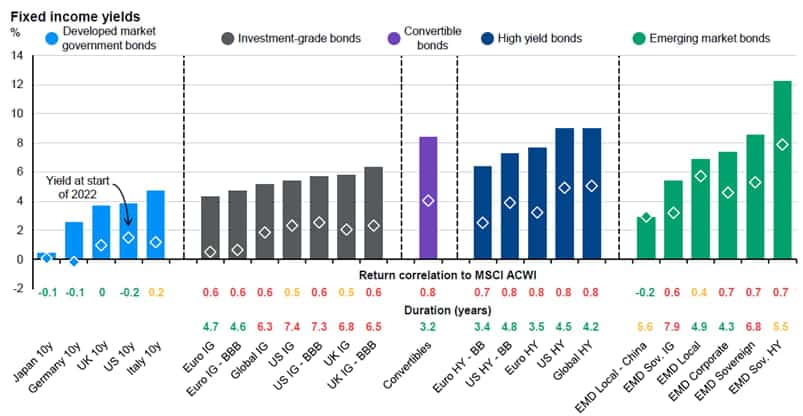

After their falls last year, bonds have far more generous yields than they began 2022 with (and higher yields than the market’s expectations of inflation going forward across most geographies). Higher yields imply much greater return potential going forward, given that bond returns over the medium term are tightly correlated with the starting yield.

Source: J.P. Morgan Asset Management Guide to the Markets Q1 2023

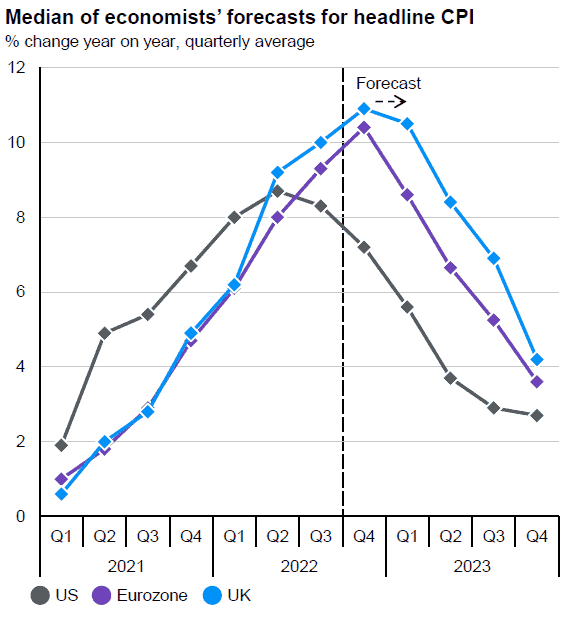

Lower starting valuations for bonds and equities are fortunate because there are still many economic and political uncertainties. Although falling in the US, inflation remains high globally, and the question of how fast it falls this year remains a key variable for markets.

Source: J.P. Morgan Asset Management Guide to the Markets UK Q1 2023

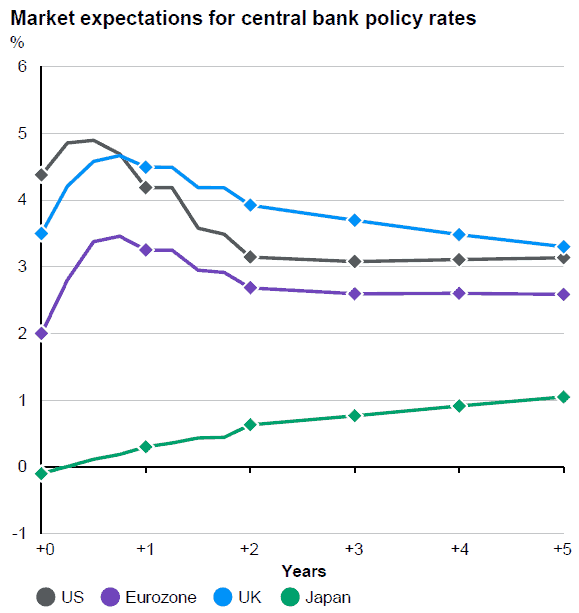

Linked to inflation is when central banks can cease raising rates. Markets are pricing in some further rate rises early this year but are forecasting that western central banks will begin cutting towards the end of the year. Markets are assuming rate cuts will happen either because inflation has fallen quickly enough and/or because recessions globally will force central bankers to back down to provide support to ailing economies.

Source: J.P. Morgan Asset Management Guide to the Markets UK Q1 2023

Any rate cuts would support bonds, but equities would likely sell off further in a recession.

Unfortunately, recessions remain the likely outcome for a number of countries in 2023 given the sheer speed and scale of rate rises last year (interest rates dampen economic activity by increasing borrowing costs, thereby curtailing consumption and investment). The UK is probably already in one, whilst Europe is likely not too far away from one. Even the US, previously very strong economically, has a good chance of tipping into recession in 2023.

However, it’s important to note that not all recessions are created equal. A mild recession would likely not lead to dramatically higher unemployment, and further asset price falls would be limited. The world has gotten used to lower interest rates and grapples with borrowing costs not seen in over 10 years. This does raise the chance of a market ‘accident’ that bleeds into the real economy (consumer confidence, unemployment, and growth), which would, in turn, lead to a more severe drawdown in equity markets. The liability driven investment selloff in UK government bonds in September and October was one such accident which narrowly avoided becoming a crisis, and there are likely to be more market weaknesses that higher interest rates will expose.

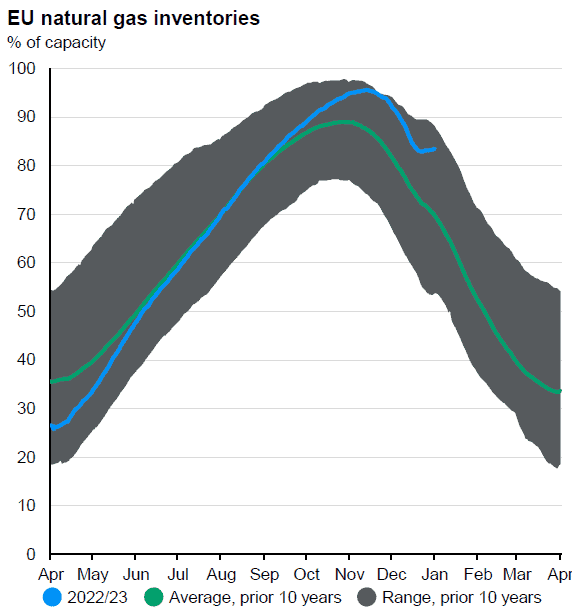

Alongside these risks are, however, several positives. Milder winter weather (as well as surprisingly substantial demand curtailment by consumers) has resulted in European gas inventories being a lot higher than average for this time of year, dramatically decreasing the risk of energy shortages both on the continent and in the UK this winter and next. If this continues, it will likely lead to lower-than-expected inflation and lower energy costs for consumers and governments through their energy support programs (which is likely to mean more consumption and investment in other areas – a key positive for European growth vs current expectations).

Source: J.P. Morgan Asset Management Guide to the Markets UK Q1 2023

China is re-opening its economy after dropping its rigid COVID controls sooner than markets expected. This will not be without some roadblocks, but it should spur further growth in the country and globally as the Chinese consumer reawakens.

While economic uncertainty is high, the indisputable silver lining is that most asset prices are now pricing in bad news. Given the relatively more attractive valuations, we are optimistic about the long-term returns of portfolios. However, we continue to favour diversification to manage what is likely to be a bumpy ride over the near term.

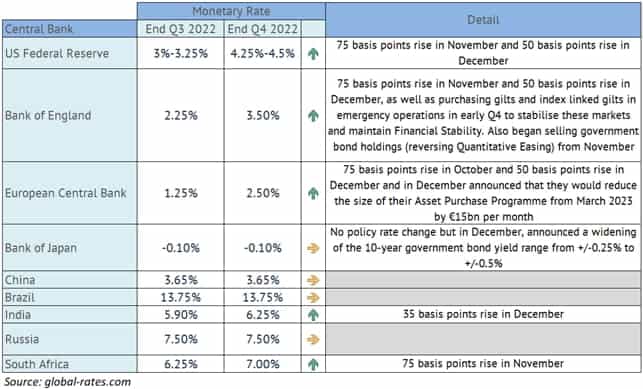

Data: Monetary Policy* (Rates & Extraordinary Measures)

The last quarter of 2022 saw continued dramatic tightening by Western central banks, with the US Federal Reserve, Bank of England and European Central Bank all raising rates by 1.25% overall and the Bank of England beginning quantitative tightening. Several other countries globally also raised rates, although the impetus was notably weaker in emerging markets, with China, Brazil and Russia all holding steady. Probably the most surprising move was from the Bank of Japan, the only central bank not to have moved up to now. In December, it widened its 10-year yield curve control band, which is likely a prelude to further tightening and immediately causing a shift upwards in its government bond yields.

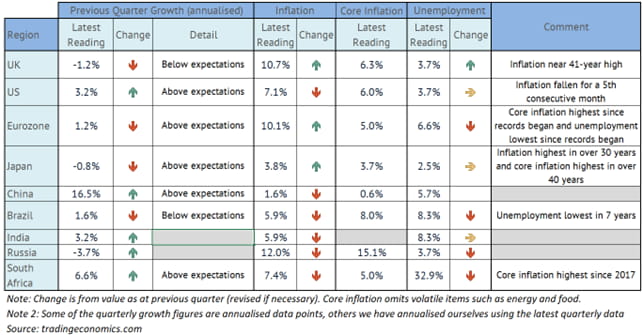

Data: Global Economies

GDP figures released in the fourth quarter were for Q3 2022 and were mixed. After two-quarters of negative growth, the US saw strong growth in Q3, but the UK’s performance was weak. Inflation appears to have begun falling in the US and maybe close to topping out in the UK and Europe, although in the latter two, it remains above levels from last quarter. Unemployment generally remained low, a positive given the global worries of the recession.

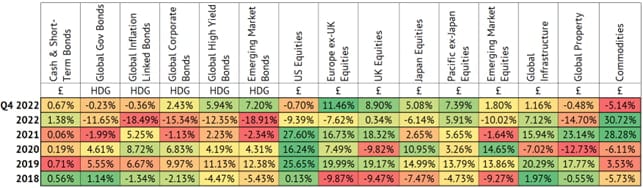

DATA: ASSET CLASSES

Note: The above are total returns, including dividends and interest payments. Asset classes with the “HDG” label are currency hedged to pounds sterling, which means that foreign currency movements are removed. Those with the “£” label indicate that we are reporting returns to British holders, which includes the effects of the foreign currency moves non-UK listed securities are exposed to.

Data source: Financial Express

Indices used: Bank of England SONIA, GBP hedged version of FTSE World Government Bond Index, GBP hedged version of FTSE WorldBIG Corporate Index, GBP hedged Bloomberg Global High Yield Index, GBP hedged version of FTSE Global Emerging Markets US Dollar Government Bond Index, MSCI North American Index, MSCI Europe ex-UK Index, FTSE All Share Index, MSCI Japan Index, MSCI Pacific ex-Japan Index, MSCI EM Index, FTSE Global Core Infrastructure 50/50 Index, FTSE EPRA NAREIT Global Index and Bloomberg Commodity Index

DATA: INDICES, COMMODITIES, CURRENCIES

Data Source: PortfolioMetrix, Bloomberg

Key

- The FTSE 100 is an index of the 100 largest companies by market capitalisation listed on the London Stock Exchange. Crucially, while these companies are priced in sterling, the majority of their revenues come from outside the UK, making the FTSE 100 more of a global rather than domestic UK index.

- The MSCI World Index gauges global developed market equity performance. This is heavily influenced by US equity performance, which, as the world’s biggest equity market, makes up more than half of the index. It is not to be confused with the MSCI All Country World Index, which includes both developed and emerging market equities.

- MSCI Emerging Market Index measures emerging market equity performance.

- Bloomberg Global Aggregate Index represents global investment-grade bond markets, mostly made up of government bonds.

- Chicago Board Options Exchange Volatility Index (VIX) measures implied volatility in the S&P 500 Index (how volatile market participants expect big US equities to be/how risky they view them to be). It is also known as the “fear index,” with higher numbers crudely representing “more fear” in markets and lower numbers crudely representing “more greed.”

- Brent Crude oil prices are a key indicator of movements in the global oil market, the world’s most important commodity as it is such an important input into economic activity (in providing energy and as a raw material in production of materials such as plastics).

This document is only for professional financial advisers, their clients, and their prospective clients. The information given here is for information purposes only and is not intended to constitute financial, legal, tax, investment, or other professional advice. It should not be relied upon as such, and PortfolioMetrix cannot accept any liability for loss for doing so. Any forecasts, expected future returns or expected future volatilities are not guaranteed and should not be relied upon. The value of investments and their income can go down and up, and you may not recover the amount of your original investment. Past performance is not a reliable indicator of future performance. Portfolio holdings and asset allocation can change at any time without notice. PortfolioMetrix Asset Management Ltd is authorised and regulated by the Financial Conduct Authority. Full calculation methodology available on request.

*Glossary of Financial Terms

- Hedging back to sterling: The risk of currency fluctuations can be removed by “hedging” the foreign currency back to the pound. In this way, a UK investor holding a US government bond or bond fund would not experience changes to the pound to US dollar exchange rate and their holding would be a lot less volatile/risky.

- High yield: High yield debt is rated below investment grade and is riskier. It has a higher yield to compensate for this additional risk.

- Monetary Policy: The decisions central banks make to influence the supply of money in an economy, primarily the setting of base rates in the economy, but also through certain extraordinary measures such as quantitative easing.

- Quantitative easing: Quantitative easing refers to expansionary efforts by central banks to help increase the supply of money in the economy (and help indirectly lift the economy). It involves the central bank purchasing financial assets, mainly government bonds.

- Quantitative tightening: A mechanism for decreasing the supply of money in the economy to cool excess growth (above a stable level). It involves the central bank allowing purchased bonds to mature or in more extreme cases selling previously purchased financial assets.

- Quarterly vs annualised growth rates: Some national statistical agencies prefer to quote country growth levels in a quarter as an actual quarterly rate (the estimate of growth over three months, x, sometimes referred to as “on quarter” growth) whilst others prefer to quote the growth over the quarter on an annualised basis (i.e. assume the growth over three months continued for a year, approximately 4x). Unless specified otherwise we quote only annualised rates using actual calculations rather than the simplified approximation of annual rate = 4 x quarterly rate.

[simple-author-box]