A Flexible Approach to Retirement Income

Flexi Access Drawdown (FAD), also known as pension Flexi Access drawdown, is the most frequently chosen retirement option. Over time it has also been called Flexible Access Pension Drawdown and Income Drawdown.

It allows people to choose how much of their pension they would like to receive each year. This is a great advantage, yet it also carries the potential risk of running out of money before they die.

If managed properly, FAD can be a beneficial way to manage retirement funds and ensure a steady income during retirement.

How does Flexi Access Drawdown Work?

Pension freedoms were introduced on the 6th of April 2015. You now have the option to draw down income from your pension in a more flexible way than before. Flexible Drawdown (FAD) allows you to take out varying amounts of money whenever you choose, usually beginning at age 55, and with up to 25% tax-free lump sum.

Not all providers offer FAD, so it’s important to check with your provider first.

As life grows more complicated, people are increasingly recognising the need for retirement income that can be adapted to their personal situation. FAD offers the chance to regularly review and alter regular income or take out one-off payments. This is an appealing option for pensioners.

Furthermore, money can be left inside the FAD plan, allowing it to gain value over time. This has the potential to boost the income that can be taken out of pensions, making it a beneficial choice.

You also have the option to buy a pension annuity in the future if you want to.

In order to access a set amount of tax-free, you must first convert four times the amount you are looking to receive into your pension pot.

Then, you must put the remaining 75% into a Flexible Access Drawdown account to get your full tax-free cash.

This account allows you to withdraw any amount of money in the year without a limit, but the income from the withdrawals will be taxed.

Why not sign up for our monthly newsletter

Each month we send out our newsletter and our latest publication. We cover all aspects of financial planning. It’s free and you can unsubscribe any time.

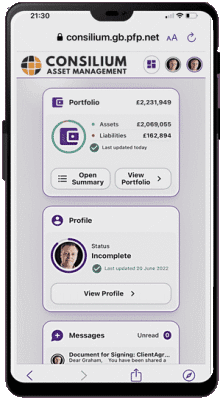

Your Personal Finance Portal

Our clients have access to our Personal Finance Portal. Clients gain access to valuations, secure messaging as well as the ability to share documents. There is also the option to integrate open banking allowing our clients to see all their finances in one place.

Access to the Portal is available on desktop, tablet or mobile.

Watch our video.

Flexi Access Drawdown Benefits

Drawdown plans provide a convenient way to access pension savings, allowing for varying levels of retirement income that can be adjusted to suit individual needs.

This flexible access is an attractive pension option for many, as it enables them to take ad-hoc lump sums or alter their regular income amounts on a regular basis.

More on Income Sustainability

Potential for Capital Growth

Staying invested in the FAD plan allows for potential growth, though there are risks in the short run. Over time, this can lead to an increase in the income you can get from your pension, which is essential for a secure retirement. We recommend getting pensions advice if you are looking at Income drawdown

Pension Drawdown and Investing

Start your Journey…

Book a Call

The initial call enables us to find out more about you and how we might be able to help you. The meeting is provided at our expense and there is no obligation on your part. Our Video outlines our services

Pension Death Benefits

Within your FAD plan, you have the option to nominate beneficiaries who will receive the benefits when you die. This is not limited to dependents, and more than one beneficiary can be chosen. Additionally, when your beneficiary dies, they can also pass the plan down to their successors.

More on Pension Drawdown

You can Phase your Tax Free Cash

With Flexi Access Drawdown, you can access part of your pension fund on an annual basis. This is called Phased Drawdown, which enables you to receive smaller amounts of tax-free cash yearly, thus allowing you to benefit from some of your income without incurring income tax.

More on Flexible Pension Drawdown

Is Flexi Access Pension Suitable?

Flexi Access Drawdown has revolutionised retirement planning, giving retirees increased autonomy. Yet it may not be the best choice for everyone as it comes with a risk due to its intricate tax rules. To determine if it is right for you, contact us: we can provide advice on the optimal pension plan. If you’d like to explore other options, Pension Wise, the Government’s website, is also available.