For any first-time buyers looking to get on the property ladder, recent events have been making that more difficult than ever. The Government’s Help to Buy scheme aims to enable millions of people to purchase their first home. This guide will tell you everything you need to know.

Why are times so hard for first-time buyers?

To set the scene, we will look at first-time buyers’ struggles. Even if they use mortgage advisors or brokers, young people find it more challenging than ever to become property owners.

In recent years, house prices have soared. This happened before the pandemic, but the stamp duty holiday offered during COVID-19 meant the property market took off. This has not stopped in our post-Covid world, and the latest stats show that house prices jumped by 15.5% from July 2021 to July 2022.

As a result, the earnings ratio to house prices is becoming less favourable. First-time buyers are paying approximately 6.5 times the average annual wage, which has increased significantly compared to a decade ago, when the multiple was just 5.25.

So, house prices have been skyrocketing, while earnings have not kept up with the pace. The saving grace in the last decade has been the record low-interest rates, meaning that at least the cost of borrowing has been relatively cheap.

Oh no, enter the interest rate increases throughout 2022 (with more expected in 2023), and suddenly, it is even more expensive to borrow once first-time buyers have managed to save a deposit. This means that higher deposits are needed to reduce the value of the mortgage since repayments are so high. First-time buyers are good at saving, though, right?

Now factor in the worst cost-of-living crisis for over 30 years, with inflation soaring past 10% and widely expected to reach the late teens. Rising energy bills, petrol prices, and food costs mean that everyone is struggling to get by, let alone save some earnings towards a house deposit.

Help is needed.

What is the Help to Buy scheme?

This government-backed help-to-buy scheme provides an equity loan to first-time buyers. It offers hope to those who have only saved a small deposit. The equity loan can be used on top of your deposit to reduce the size of the mortgage required and increase your chances of being accepted by a lender.

Please note that the details in this article are relevant to the scheme in England, and different rules apply in Scotland and Wales.

Am I eligible for the Help to Buy scheme?

As with anything, there are restrictions and requirements. If you are unsure, please speak to your mortgage broker or advisor. We offer a comprehensive mortgage advice service and would be happy to help.

Firstly, this scheme will close to new applications on 31st October 2022 at 6 pm.

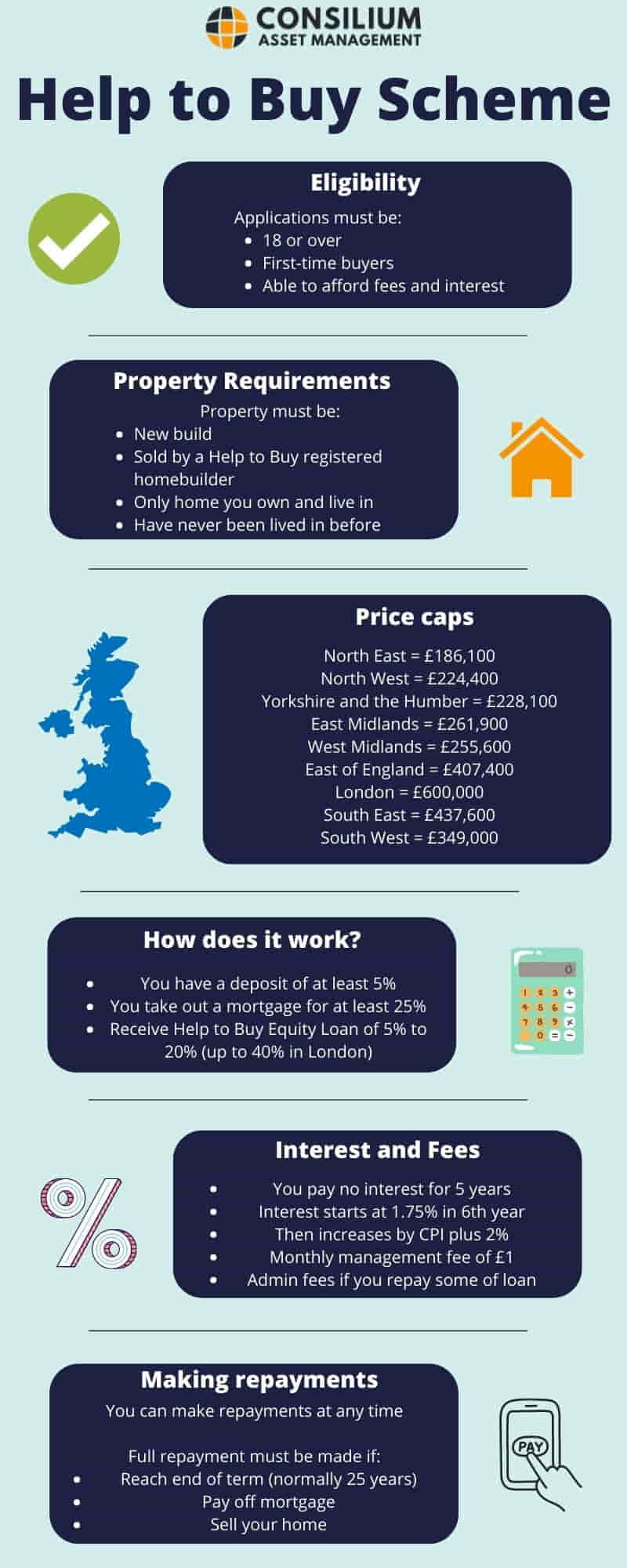

The eligibility criteria are as follows:

- Applicants must be age 18 or over

- Must be a first-time buyer

- Able to afford the relevant fees and loan interest payments

- You must never have owned a home or land in the UK or abroad

- You may apply as a single applicant or joint, but all applicants must meet these criteria

What property can I buy with the Help to Buy scheme?

There are strict requirements on the property that you purchase:

- New-build properties only

- It must be sold to you by a Help to Buy registered homebuilder

- This must be the only home you own and live in

- It cannot have been lived in by anyone before you buy it

In addition to this, there is a cap on the property purchase price that the scheme can cover. These vary depending on the region in which the property is situated.

These caps are:

North East = £186,100

North West = £224,400

Yorkshire and the Humber = £228,100

East Midlands = £261,900

West Midlands = £255,600

East of England = £407,400

London = £600,000

South East = £437,600

South West = £349,000

How does the Help to Buy scheme work?

This is a frequently asked question. If eligible and accepted into the scheme, you receive:

- Your loan to cover anywhere from 5% to 20% of the purchase price

- For London, this can be up to 40%

As part of this, you must pay at least a 5% deposit and take out a repayment mortgage for at least 25% of the property. A mortgage advisor can help you with this.

What interest do I need to pay?

The loan from the help-to-buy scheme is free of interest for the first 5 years. This means your equity loan is essentially free for 5 years. In the 6th year, your interest begins at 1.75%. Interest is only due to the amount you have taken out as part of the scheme. Your interest on the mortgage will likely be higher and will be charged from the first year following the purchase.

Although charged annually, the interest is paid monthly, so payments will be made yearly.

For example – assume you purchase a property for £150,000 and split the purchase as follows:

House purchase = £150,000

Deposit = £15,000 = 10%

Help to Buy Equity Loan = £30,000 = 20%

Repayment mortgage = £105,000 = 70%

In this case, your interest in the 6th year will be as follows:

- Equity Loan = £30,000

- Interest in 6th year = 1.75% = £525 per year

- Monthly interest payments = £43.75 per month

In the 7th year and beyond, the rate of interest charged increases by CPI plus 2%. This takes effect from April.

What fees are involved with the Help to Buy scheme?

All the standard fees for purchasing a home and taking out a mortgage still apply. An idea of these can be found on our first-time buyers FAQs page.

Regarding the Help to Buy scheme, you must pay a monthly management fee of £1. This applies from the start of the loan right up until you pay it off. If you remortgage or repay some of the equity loans, administration fees will also be.

When can I make repayments of the equity loan?

Repayments can be made anytime, but you must get a chartered surveyor to value your home first.

The minimum permitted repayment is 10% of the value of your home. This is 10% of the total value and not 10% of the equity loan you took out as part of the scheme.

After repaying some loans, your interest payments will be lower because the interest will be calculated on the outstanding equity loan rather than the total amount.

When must I pay back all of the equity loan?

Unfortunately, you cannot keep the loan forever, and there comes a time when you must repay the entire loan. This happens when one of the following occurs:

- You reach the end of your equity loan term – this usually is 25 years

- Pay off your repayment mortgage

- You sell your home

The amount you repay after selling your home will be the original percentage you loaned. This percentage will be applied to the market value or the sale price, whichever is highest.

Following on from the previous example:

House purchase = £150,000

Deposit = £15,000 = 10%

Help to Buy Equity Loan = £30,000 = 20%

Repayment mortgage = £105,000 = 70%

If you were to sell this property for £200,000, you would be required to repay 20% of this amount:

- Repayment of equity loan = 20% of £200,000 (sale price) = £40,000

ALTERNATIVELY, if you have already made a partial repayment, the equity percentage that you repaid will be deducted from your original loan percentage.

House purchase = £150,000

Deposit = £15,000 = 10%

Help to Buy Equity Loan = £30,000 = 20%

Repayment mortgage = £105,000 = 70%

Assume you have repaid 10% previously and are now selling the property for £200,000:

- Repayment of equity loan = 20% – 10% = 10% of £200,000 (sale price) = £20,000

How do I apply for the Help to Buy scheme?

Since this only applies to new-build homes, you must register with a Help to Buy agent in the area where you want to purchase your home.

Visit the gov.uk page on the Help to Buy scheme for more information and links.

Like everything, this scheme has advantages and disadvantages. The main and most obvious positive is that you only need a minimum 5% deposit, which opens up opportunities for many first-time buyers. Furthermore, having a loan means accessing more competitive mortgage rates. This is because you will need less mortgage compared to the purchase price of your home.

The other main advantage is that you pay no interest for 5 years. For most first-time buyers, these are the most problematic years because your salary is still increasing, and you have most likely used up your savings purchasing the house, furniture, etc. The 5-year period allows you to regain control of your finances and hopefully be in a better position once the interest begins.

You can pay off the equity loan at any time, which gives you a degree of flexibility. If you suddenly have money, you can use it immediately and be free of the equity loan.

However, you must be careful because interest rates can rise quickly from the 6th year onwards. In the current climate, CPI is over 10%, so the interest in the 7th year could rise 15%. This can start to accelerate quickly, so do act with caution.

Another point to highlight is that your repayment amount is based on a percentage rather than a fixed amount. As the example above demonstrates, you will likely repay more than you borrowed if the house price increases before you sell.

A large restriction on this scheme is that it is only available on new-build homes. This makes it very restricted in terms of availability. If you have your heart set on a location and there are no new-build homes available, you will need to compromise on location or timings.

Overall, the help-to-buy scheme opens some doors for certain people. Getting on the property ladder with only a 5% deposit is appealing. If you meet all the eligibility criteria, then this scheme is worth exploring because of its attractive aspects. But be careful because there are dangers as well with regard to high interest rates and possible negative equity. Please speak to a mortgage advisor or broker before making final decisions. Our mortgage advice service comes with a free initial chat. We will discuss your situation before making any recommendations.