Q2 2021 Quarter End Review

In Brief

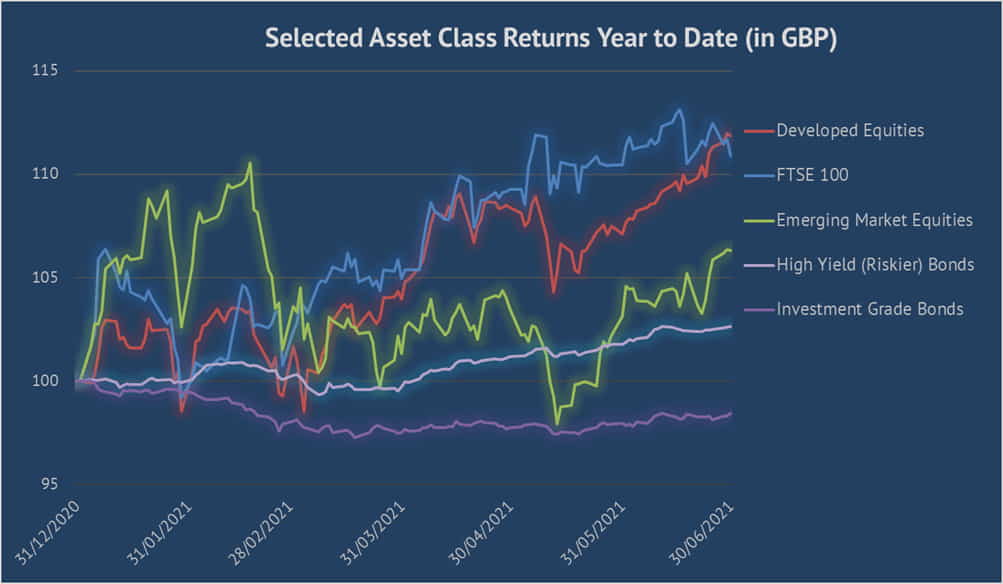

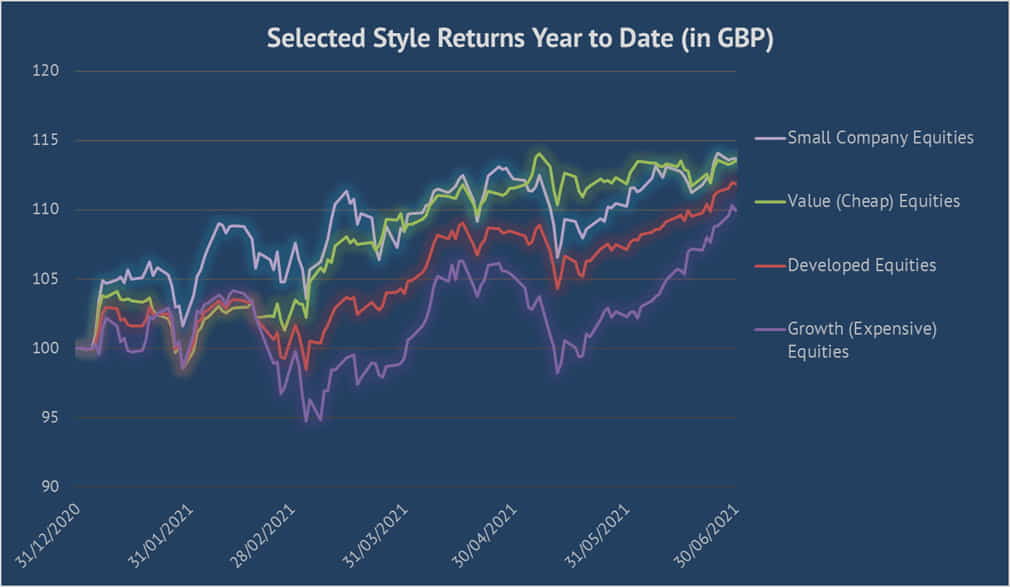

- Q2 2021 saw strong gains for most asset classes, with equities, particularly ‘growth’ equities, performing particularly well.

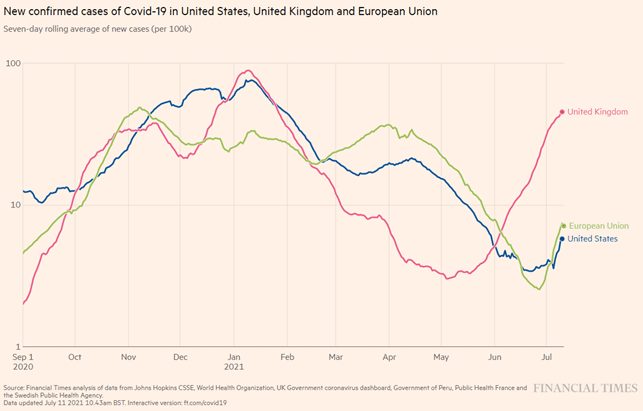

- There was growing nervousness around the sustainability of the global recovery as Delta variant COVID cases picked up, China slowed, and some fiscal support in developed markets began to be withdrawn.

- This nervousness translated into reduced inflation fears, lower global rates, and higher bond prices. It also caused growth equities to outperform value equities.

Quarter Overview

April was a good month for most economies on the data front, with some very notable exceptions in Japan and India, which saw escalating COVID cases. Bond yields that had risen in prior months due to inflation expectations started to fade a little, which boosted bond prices. Finally, sustainability returned to investors’ minds as the UK, the US and China all announced larger and faster-planned carbon emissions reductions relative to their previous commitments.

May saw strong economic data overall, although there were concerns about the chance of inflation running too hot and central banks prematurely tightening monetary policy. Modestly higher inflation and improved global growth prospects benefitted more cyclical companies over the month – a continuation of a trend from earlier in the year, albeit one that did not persist into June. On the COVID front, daily cases began to fall again in India and Japan later in the month.

June again delivered generally positive economic news globally and good news regarding COVID cases and vaccine rollouts. However, a notable exception was a large uptick in cases in the UK due to the Delta variant, which delayed the final step of economic reopening. There were also indications that the Delta variant was becoming more prevalent in the US and Europe. There were hints of sooner-than-expected interest rate rises in the US, which helped to settle longer-term inflation concerns. Oil prices continued to rise, increasing 10% in June – they are now up over 50% year to date.

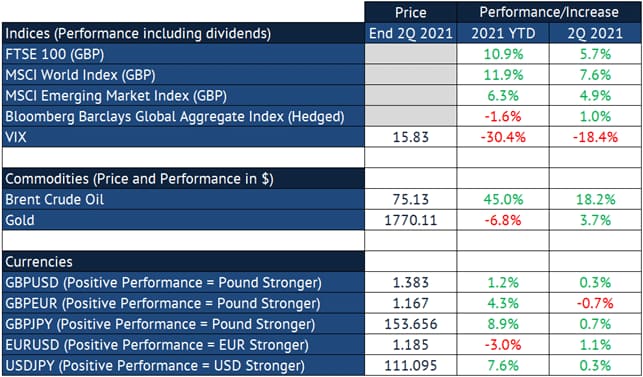

The second quarter was another positive quarter for markets and particular equities. As measured by the VIX index, market volatility fell 18.4% over the quarter, and developed market equities (as measured by the MSCI World Index, including dividends) were up 7.6% in sterling terms over the quarter. The FTSE 100 returned 5.7%, whilst emerging market equities (MSCI EM Index) were up 4.9%. Global bond yield drifted downwards, which was positive for bond prices – higher-quality bonds (as measured by the Bloomberg Barclays Global Aggregate) rose 1%. Lower quality high-yield bonds, more geared to the strength of the global economy, fared even better, up 2.9%. Most commodities again rallied over the quarter, with oil up 18% and gold up 3.7%.

Data source: Financial Express Indices used (including interest & dividends): Defensive Investment Grade Bonds - GBP hedged Bloomberg Barclays Global High Yield Index; Riskier Bonds (High Yield) - GBP hedged Bloomberg Barclays Global High Yield Index, Developed World Equities - MSCI World Index in GBP; Emerging Market Equities - MSCI Emerging Markets Index in GBP; FTSE 100 (UK Large Capitalisation Equities)

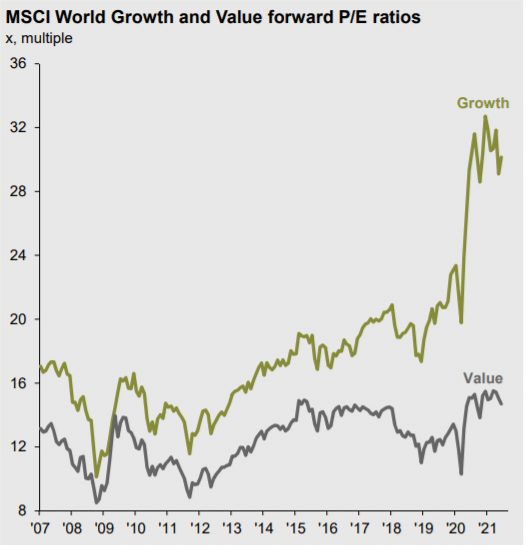

Diving into performance within indices, ‘high-price’ securities (often described as growth, momentum, and quality companies) bounced back strongly after a weaker start to the year, up 10.7% over the quarter. They often perform better in markets and are more nervous about future growth as they’re seen as being better able to generate that growth without relying on a broader economic recovery. Smaller and cheaper ‘value’ companies were more subdued, up 4.8% and 4.6%, respectively, over the quarter.

Data source: Financial Express Indices used (including interest & dividends): Developed World Equities - MSCI World Index in GBP; Growth Equities – MSCI The World Growth Index; Value Equities – MSCI World Value Index; Small Company Equities – MSCI World Small Cap Index

In Q4, the pound was up 1.5% against the euro, rose 4.2% against the US dollar, and was up 3.6% against the yen. Over the year as a whole, the pound fell 5.4% against the euro, was up 3.1% against the dollar, and fell 2% against the yen.

Looking Forward

The second quarter of 2021 was notable in that markets began to shift away from the ‘reflation’ narrative of future high expected growth and high expected inflation. This narrative has been prevalent since the announcement of successful vaccine trials in November 2020. It led to a dramatic increase in global longer-dated bond yields in the first quarter as well as the outperformance of cyclical and ‘value’ equities over ‘growth’ and ‘quality’ equities.

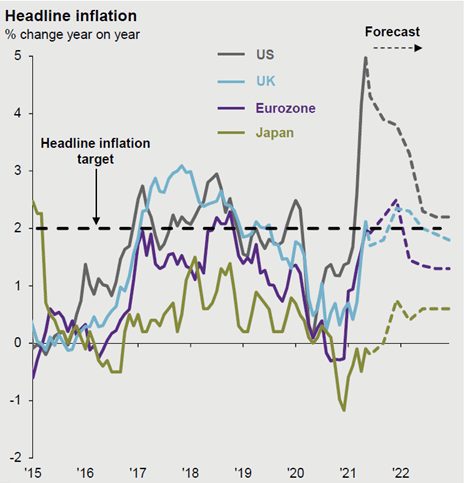

Q2 2021 saw some high inflation figures, with UK inflation the highest since July 2019 at 2.1% year-on-year for May, whilst the US figure jumped to 5%, the highest since 2008. However, markets largely took these numbers in their stride, attributing the higher points to the fact that their annual figures compared against the depressed lockdown levels of 2020. Market participants also began to more heavily incorporate the views of central banks, which had been forecasting these high levels to be temporary, reverting closer to their targets of 2% by the end of the year. The June US Federal Reserve meeting helped reinforce this message by indicating that interest rate rises were expected to be brought forward to rein in inflation– accelerating a fall in inflation expectations (and bond yields) towards the end of the quarter.

Source: J.P. Morgan Asset Management Guide to the Markets Q3 2021

At the same time, again, in the face of strong recent growth numbers, investors have started to get more nervous about how strong the economic recovery really will be. Partly, this is due to fears around the looming withdrawal of fiscal support measures. Since July, the UK has been beginning to taper its furlough support scheme and end the stamp duty holiday on property purchases. Many US states are also winding down COVID-related unemployment benefits. Another worry is that China, after leading the world out of the COVID-induced slowdown, has recently seen its recovery taper off. Its most recent purchasing managers’ index (PMI) figures for services and manufacturing have barely been above 50, delineating between expectations of future economic expansion and contraction. In addition to these concerns, the highly virulent “Delta” SARS-CoV-2 variant is causing a spike in cases in many Western countries after having emerged from and wrought havoc in India. There is a real worry that the variant will cause a delay in economic reopening in these countries or, if the openings do progress, stunt the willingness of citizens to go out and spend.

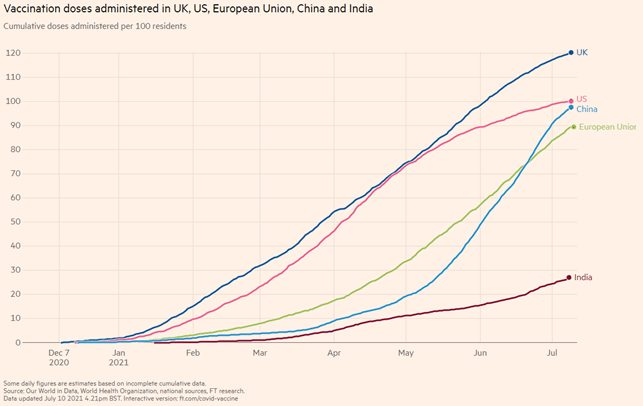

Source: Financial Times, accessed 11 July 2021

Importantly, these falling inflation concerns and nervousness around future growth have not translated into falling equity markets. Rather, they have led to falling global interest rates (and hence rising bond prices, given that bond prices and rates move inversely) and a renewed preference for ‘growth’ companies instead of cheaper ‘value’ companies, given that, as the name suggests, growth companies are seen as better able to grow earnings in less vibrant economic conditions.

We take these concerns seriously, but we think markets are perhaps a little too optimistic about inflation and pessimistic about growth. In other words, we think some life is probably left in the reflation trade.

Whether this is true or not rests on whether growth remains strong, and this largely depends on developed nations weathering the Delta variant onslaught. The good news is that current vaccines appear to be very successful at mitigating deaths and hospitalisations, even if they appear somewhat blunted in preventing milder infections. The UK, with its impressive vaccination levels (almost 87% of the adult population has had one dose, and almost 2/3rds has been fully vaccinated), is currently in the midst of what seems to be a giant experiment: given a high enough vaccination rate, is it possible to learn to live with the virus in the way that we have learned to live with flu? If successful and no nastier variants emerge, then returning to previous levels of growth is just a matter of countries vaccinating enough of their populations. The good news is that most developed nations are doing very well in this regard (including previous laggard Europe), although most emerging markets still have a long way to go.

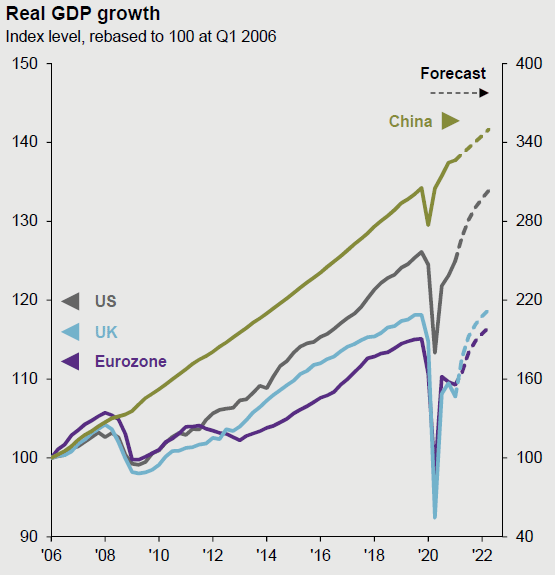

Assuming the Delta variant doesn’t lead to renewed lockdowns, consensus expectations are for economies to have recovered their former GDP levels by the end of 2021/beginning of 2022, with the US exceeding previous growth trends. This would argue for global rates being higher than now and room for cyclical stocks to perform well. There is potential fiscal upside for Europe, too, given that Europe’s recovery fund (technically “The Next Generation EU” fund), a €750bn fiscal stimulus in the form of loans and grants, with a focus on a greener economy, is only just starting to kick into action and is planned to continue until 2023.

Another reason why there is perhaps room left in the recovery trade is the extreme divergence in valuations between growth vs value companies. This doesn’t affect the probability of the reflation trade resuming but does mean that if it does, valuations are likely to amplify the outperformance of value companies.

Whilst we are broadly optimistic about future market returns and a resumption of the reflation trade, we are fully aware that risks to this view remain: as discussed, Delta, or another worse variant of SARS-CoV-2, could derail the recovery, and even if it doesn’t, premature fiscal and monetary tightening could choke off global growth. We thus continue to maintain diversification across asset classes, investment styles, currencies, countries and fund managers to ensure that portfolios are robust to these risks. That said, we do continue to have relative underweight to areas we think are expensive (US and growth equities) and which we thus think have less upside potential, whilst tilting towards other parts of the market we think are better value and thus have greater upside, like cheaper companies and the UK, emerging markets and Japanese equities.

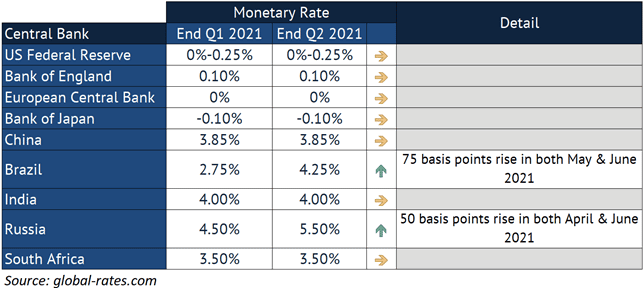

DATA: MONETARY POLICY* (RATES & EXTRAORDINARY MEASURES)

There was little change in developed market central bank action over the quarter as rates were kept low and central bankers maintained quantitative easing. Certain emerging markets began to tighten as inflation ticked higher.

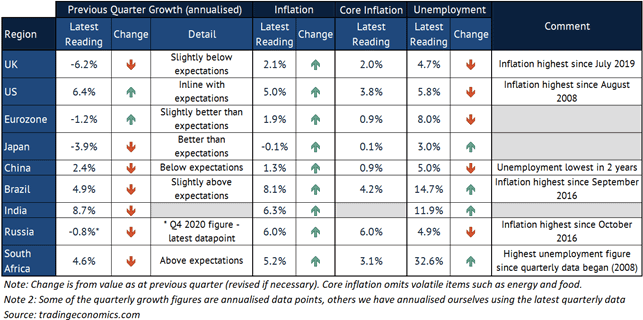

DATA: GLOBAL ECONOMIES

GDP figures released in the second quarter were for Q1 2021, a quarter that saw Europe and many emerging markets negatively impacted by coronavirus second waves, resulting in lockdowns and, thus, weaker growth levels. Inflation picked up during the second quarter, while unemployment was mixed, generally falling in developed markets as economic restrictions were lifted but increasing in emerging markets struggling with further cases.

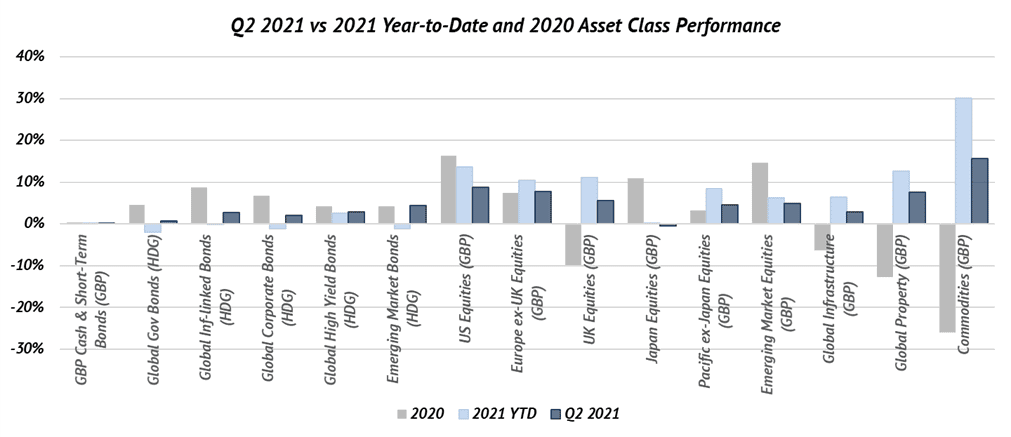

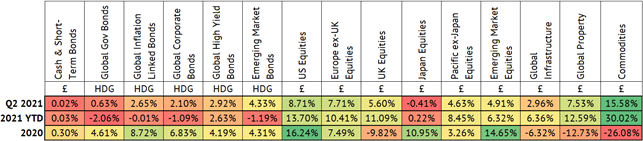

DATA: ASSET CLASSES

It was a strong quarter for most assets, particularly almost all equity asset classes, led by US equities. However, commodities were the best-performing asset class, fuelled by impressive gains in oil. Japanese equities struggled in sterling terms, however.

Bonds had a good quarter, given that global yields fell from their Q1 highs. After a poor first-quarter performance, emerging market bonds were the best-performing bond asset class.

Note: The above are total returns, including dividends and interest payments. Asset classes with the “HDG” label are currency hedged to pounds sterling, which means that foreign currency movements are removed. Those with the “£” label indicate that we are reporting returns to British holders, which includes the effects of the foreign currency moves non-UK listed securities are exposed to.

Data source: Financial Express Indices used: 3m GBP LIBOR, GBP hedged version of FTSE World Government Bond Index, GBP hedged version of FTSE WorldBIG Corporate Index, GBP hedged Bloomberg Barclays Global High Yield Index, GBP hedged version of FTSE Global Emerging Markets US Dollar Government Bond Index, MSCI North American Index, MSCI Europe ex-UK Index, FTSE All Share Index, MSCI Japan Index, MSCI Pacific ex-Japan Index, MSCI EM Index, FTSE Global Core Infrastructure 50/50 Index, FTSE EPRA NAREIT Global Index and S&P Goldman Sachs Commodity Index

DATA: INDICES, COMMODITIES, CURRENCIES

Key

- The FTSE 100 is an index of the 100 largest companies by market capitalisation listed on the London Stock Exchange. Crucially, while these companies are priced in sterling, the majority of their revenues come from outside the UK, making the FTSE 100 more of a global rather than domestic UK index.

- The MSCI World Index gauges global developed market equity performance. This is heavily influenced by US equity performance, which makes up more than half of the index as the world’s biggest equity market. The index is not to be confused with the MSCI All-Country World Index, which includes both developed and emerging market equities.

- MSCI Emerging Market Index measures emerging market equity performance.

- Bloomberg Barclays Global Aggregate Index represents global investment-grade bond markets, mostly made up of government bonds.

- Chicago Board Options Exchange Volatility Index (VIX) measures implied volatility in the S&P 500 Index (how volatile market participants expect big US equities to be/how risky they view them to be). It is also known as the “fear index,” with higher numbers crudely representing “more fear” in markets and lower numbers crudely representing “more greed.”

- Brent Crude Oil prices are a key indicator of movements in the global oil market. Oil is the world’s most important commodity as it is such an important input into economic activity (providing energy and as a raw material in the production of materials such as plastics).

Data Source: PortfolioMetrix, Bloomberg

*Glossary of Financial Terms

- Hedging back to sterling: Currency fluctuations can be eliminated by “hedging” the foreign currency back to the pound. In this way, a UK investor holding a US government bond or bond fund would not experience changes to the pound-to-US dollar exchange rate, and their holding would be much less volatile/risky.

- High yield: High-yield debt is rated below investment grade and is riskier. Its higher yield compensates for this additional risk.

- Monetary Policy: The decisions central banks make to influence the money supply in an economy, primarily the setting of base rates, but also through certain extraordinary measures such as quantitative easing.

- Quantitative easing: Quantitative easing refers to expansionary efforts by central banks to help increase the money supply in the economy (and help indirectly lift the economy). It involves the central bank purchasing financial assets, mainly government bonds.

- Quantitative tightening: A mechanism for decreasing the money supply in the economy to cool excess growth (above a stable level). It involves the central bank allowing purchased bonds to mature or, in extreme cases, selling previously purchased financial assets.

Quarterly vs annualised growth rates: Some national statistical agencies prefer to quote country growth levels in a quarter as an actual quarterly rate (the estimate of growth over three months, x, sometimes referred to as “on-quarter” growth), whilst others prefer to quote the growth over the quarter on an annualised basis (i.e. assume the growth over three months continued for a year, 4x). We tried to quote only an annualised rate above using the following approximate relationship: annualised rate = 4 x quarterly rate.