Welcome

At Consilium Asset Management, we specialise in helping clients with their retirement planning. Life seems much more complicated now than it did a few years ago, but for many people, planning for retirement can seem complex and confusing.

Whether you are near, in retirement, or have some time to go, we can help you.

Income in retirement can come from many sources, such as rental properties, investments, pensions, and businesses. Pulling this altogether might seem complicated, but that’s where we come in.

Our unique Retirement and Wealth Management strategy can make all the difference in retirement.

About ConsiliumThe majority of our clients have a number of concerns about their finances

“We need guidance and a plan to take us into retirement.”

“We want our investments to work well and as well as being tax efficient.”

“We want to good standard of living & the retirement we always dreamed of.”

Financial Advice and the Benefits

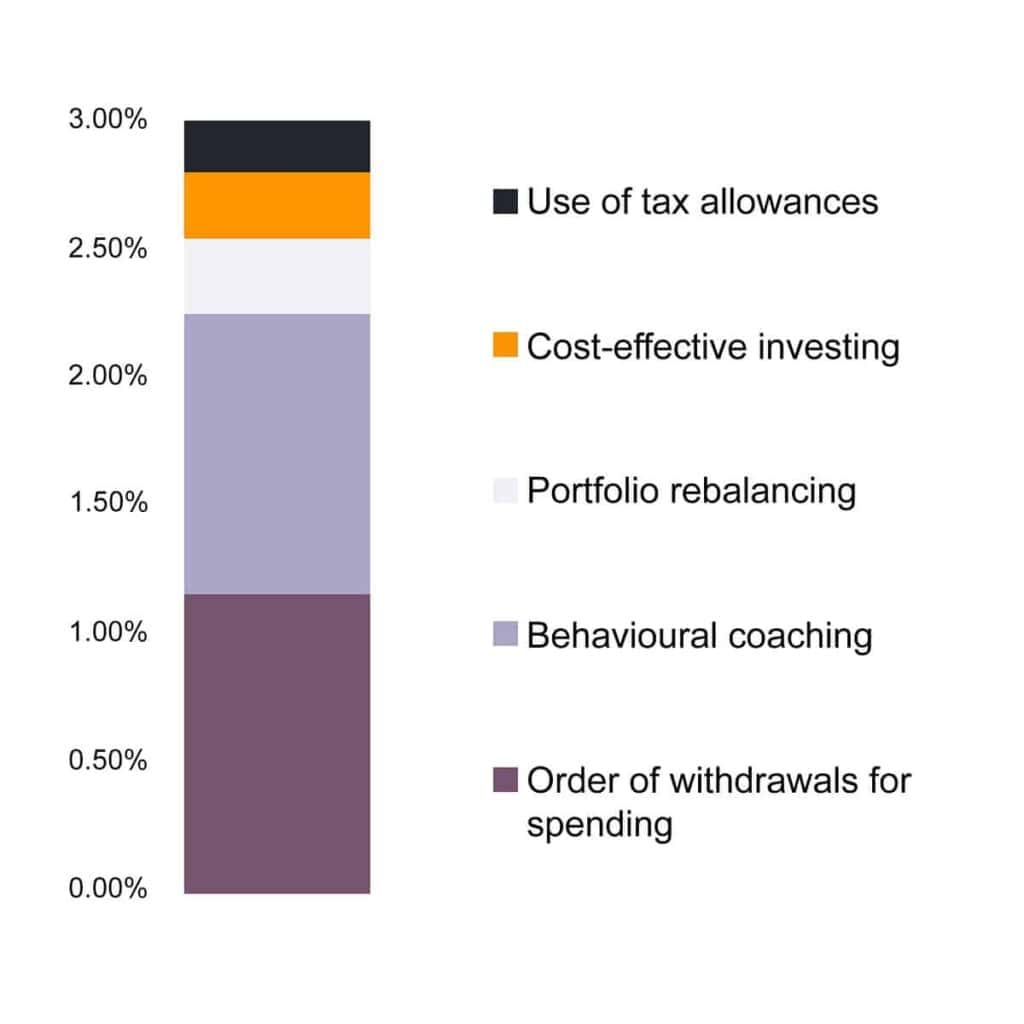

A 2020 study suggests advice could enhance returns by 3% each year. To find out more information click the button below.

*Vanguard UK – Putting a value on your value Advisers Alpha in the UK – June 2020

What we can do for you.

Planning Today For A Secure Tomorrow.

Explore

We help navigate your financial priorities.

Confidence

Your retirement plan is on the right path

Build

Dreams and aspirations are your plan’s foundation.

Choice

Choice allows focus on essentials like family and friends.

Refine

We’ll adjust your plan after showing it to you.

Freedom

Have the freedom in retirement that you have dreamed of.