Slipping through the investment risk cracks

Assessing a client’s attitude to risk is a key part of the advice journey. This is generally done using questions that explore the client’s feelings concerning certain aspects of investing. Many specialist risk profiling tools provide these questionnaires and often advice firms write their own questions.

Once completed, the results of the questionnaires are used to determine the client’s risk profile, which is used to determine the recommended mix of assets for that client.

Although this might seem a sensible approach, it is not necessarily so. Giving good investment advice is not as easy as it sounds, and when it comes to the science of investment combined with human emotion, cracks can appear in the advice process.

Risk profiling is not foolproof

Generally, clients will be given a risk score following their completed questionnaire. Frequently a scale is used, for example, 1 to 5. Other risk profiles may be given as a written description. Examples of these include cautious, balanced, and adventurous.

When it comes to deciding on an asset allocation (mix of assets) for a particular client, the first decision to be made is the % of growth assets (generally stocks, shares and property) and the % of defensive assets (cash and fixed interest assets such as bonds) that should be used.

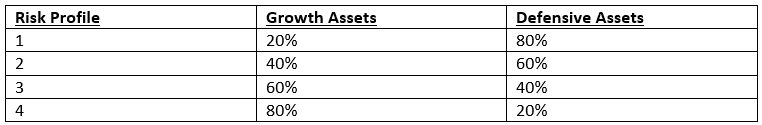

An example of how risk profiles could correlate to asset allocation is shown below:

Given the small number of risk profiles, the gaps between the different asset allocations are very large at 20%. Looking at clients and considering their feelings, emotions and ability to take risks is a complex exercise and not one that can then categorise people into 1 of 4 groups. In practice, a client who should have a 50/50 split between growth assets and defensive assets could end up either with 40/60 or 60/40. These two asset allocations would give different investment results in volatility (fluctuation in value) and returns. This demonstrates how if done incorrectly, risk profiling can lead clients to slip through the cracks.

Accurately mapping risk profiles

Another major problem can occur when marrying up a given risk profile with the recommended asset allocation. In some cases, firms may use a third-party tool for their risk questionnaire and a different third party for their investment management. Other firms manage the investments themselves. The issue is that some risk questionnaires will give no guidance on the recommended asset allocation for all the different profiles that clients could be in. A ‘balanced’ investor from one risk questionnaire may completely differ from a ‘balanced’ investor from another.

To demonstrate this, industry experts Financial Express conducted a survey in 2018 and observed that 91% of advisers are using some variety of risk questionnaires with their clients. However, only 25% used a tool to ensure that their portfolios’ risk level accurately matched their chosen risk profile. Furthermore, 52% of those using risk mapping tools had not reviewed the methodology behind the mapping of their risk to their asset allocation.

It is also worth noting that asset allocation is not the only aspect of an investment that should be affected by a risk profile. Other factors are important such as views on ESG investing, preferences towards passive or active fund management, and the time horizon of the investment. The regulator has previously warned of “shoehorning”. This is when clients are placed directly into certain risk-rated portfolios that ‘match’ their measured attitude to risk. In isolation, this already shows a lack of consideration for other factors. Now factor in that the mapping from attitude to risk to asset allocation may be flawed. It certainly doesn’t appear to be in the best interest of the client.

Finding the right investment solution

For some time, we have had concerns about the issues with risk profiling and investment advice. We had always felt that technology should provide a better solution for our clients. We have spent many hours and considerable time trying to find the ideal investment solution. Our aim is to provide investment advice that is individually tailored and customised for each client. The only way to make this cost-effectively is achieved by the use of technology. We use a risk questionnaire that seamlessly transferred to a recommended portfolio based on all the relevant factors. We do not want any of our clients to slip through the cracks. Our strategic partner, to provide customised portfolios is PortfolioMetrix.

PortfolioMetrix is a specialist Discretionary Fund Manager with a highly qualified team whose sole purpose is to manage investments daily. They, like us, firmly believe in high-quality financial planning. This puts our client interests at the heart of everything. Their commitment in this area has been recognised through countless awards since they first started in 2010.

The Financial Personality Assessment provided by PortfolioMetrix has been designed by academics and is regularly tweaked and improved. Each client is given a risk score from 1 to 100, with views on ESG Investing in addition to a client’s active or passive approach to investing. As a result, we can create portfolios unique to each client that fully reflect various factors. We are provided with various recommended asset allocations based on the client’s risk score. The service takes into account the many other influences as well as attitudes to risk. In a recent PortfolioMetrix whitepaper called “Risky Business”, they accurately state that risk is just one dimension of portfolio construction, but there are many more dimensions that need to be aligned to the client’s preferences to ensure the portfolio delivers the client’s goals in a way that makes them comfortable.

Furthermore, the risk profiling and the investment management processes have been designed to work seamlessly together. They offer a discretionary managed service, which gives their investment experts the freedom to adjust the portfolios in line with shifting market conditions. This added dynamic is rarely seen in the market and allows clients to benefit from the latest trends.

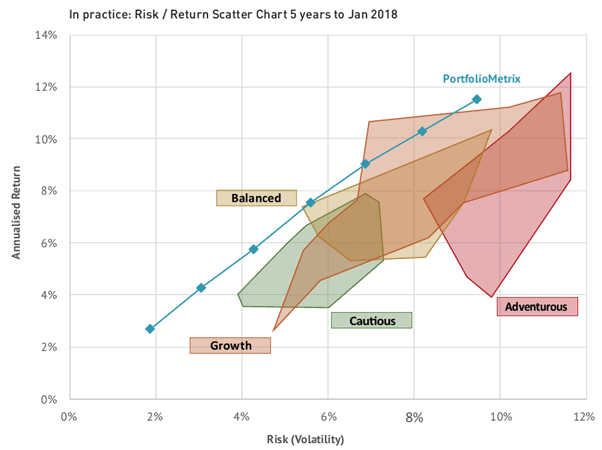

As part of the research for their 2018 whitepaper “Risky Business”, they analysed the risk (measured in volatility) and investment return for the 20 largest multi-asset funds over the previous five years. They looked at these in terms of the four risk labels often used: Cautious, Balanced, Growth and Adventurous. The chart below shows the areas in which the different funds could be found.

(Image and notes taken from PortfolioMetrix whitepaper “Risky Business”, written by Mike Roberts, 1st May 2018)

This graph visibly demonstrates that using labels for risk profiles is not a consistent and reliable approach. The blue PortfolioMetrix line shows the sliding scale that their portfolios lie on and how their methodology has provided excellent returns during that period.

Summary

As financial advisers, we are paid by our clients to recommend appropriate investments based on their situation and needs. Clients’ vastly different requirements cannot be squeezed into one of four categories based on a set of questions written by unrelated third parties. Living in today’s modern world where diversity and individuality are celebrated, and this should be no different with investments. Clients deserve to have unique plans for their unique situations, but sadly this is often not the case.

We continue to be passionate about providing the best possible service to our clients. A service that is tailored to them and assists them with meeting their financial objectives. Based on our research and the evidence in this article, we are confident that PortfolioMetrix gives our clients the highest chance of investment success. If you would like to find out more, please get in touch with us today to book your free initial consultation.

References:

Risky Business – Whitepaper written by Mike Roberts of PortfolioMetrix, released 1st May 2018