Why Portfolio Rebalancing Matters: Benefits and Practical Steps for Investors

Rebalancing your portfolio is a simple but powerful way to keep your investments working to match your objectives and risk comfort. This piece explains what rebalancing means, why it matters and how to do it in practice. Market moves and changes in your personal circumstances can push a portfolio away from its intended mix; by rebalancing you bring it back in line with your goals and tolerance for risk. We explain the core concept, the benefits, common rebalancing approaches and how sound financial planning supports the process.

What Is Portfolio Rebalancing and Why Is It Essential?

Portfolio rebalancing is the disciplined process of restoring the intended proportions of assets in an investment portfolio. It matters because, over time, different assets will grow or shrink at different rates. Left unchecked, those shifts can change the portfolio’s risk profile and make it unsuitable for the investor’s original plan.

How Does Asset Allocation Drift Affect Your Investment Risk?

Asset allocation drift happens when market movements alter the size of positions in your portfolio. For example, a strong run for equities can leave your portfolio overweight in shares and more exposed to market swings than you expected. If you do not address that drift, the portfolio may no longer match your risk appetite or financial objectives. Regular monitoring and timely adjustments reduce that mismatch.

Why Maintaining Your Target Asset Allocation Matters

Keeping to a target allocation helps preserve the balance between growth and protection you chose when you set your plan. It also reduces the temptation to make emotional decisions during volatile periods. Practical tactics — such as rebalancing on a set schedule or using predefined trigger thresholds — help maintain discipline and keep the plan on track.

What Are the Key Benefits of Regular Portfolio Rebalancing?

Rebalancing on a regular basis delivers clearer risk control, better alignment with financial goals and greater investment discipline. Taken together, those benefits help improve the chance of meeting long-term objectives without taking unintended risk.

How Does Rebalancing Help Manage Investment Risk?

By resetting allocations, rebalancing trims positions that have grown beyond their target and boosts those that have lagged. That reduces concentration risk and helps maintain the overall risk level you set. Research generally shows that regularly rebalanced portfolios can deliver steadier, risk-adjusted performance, though outcomes depend on market conditions and the method you choose.

There is also growing interest in advanced techniques, including dynamic approaches that adapt to changing markets — for example, algorithms and machine learning methods designed to optimise rebalancing decisions.

Dynamic Portfolio Rebalancing for Optimal Returns & Risk

Managing portfolios requires a balance between risk control and seizing opportunities created by price movements. Optimal portfolio construction aims to reduce risk while pursuing the best returns available under current market conditions. This paper examines an alternative approach that uses Reinforcement Learning (RL) to adapt rebalancing to changing market risks and potentially enhance returns.

Dynamic portfolio rebalancing through reinforcement learning, Q Cao, 2022

In What Ways Does Rebalancing Align Your Portfolio with Financial Goals?

Rebalancing ensures the portfolio continues to reflect your priorities as they evolve. Life changes — approaching retirement, starting a family or changing income — can shift your planning needs. Periodic rebalancing, combined with a review of your objectives, keeps your investments aligned with those changing goals.

How to Rebalance Your Investment Portfolio Effectively?

Effective rebalancing follows a clear, repeatable method that suits your circumstances. Two common approaches are time-based rebalancing and threshold-based rebalancing; each has practical merits depending on your preferences and cost considerations.

What Are Time-Based and Threshold-Based Rebalancing Strategies?

Time-based rebalancing means making adjustments at set intervals — for example, quarterly or annually — regardless of short-term market moves. It’s simple and predictable. Threshold-based rebalancing waits until an asset class moves beyond a defined band (commonly 5–10%) before acting. That can reduce trading when markets are calm but keeps you protected when allocations drift materially. The right choice depends on trading costs, tax considerations and how actively you want to manage the portfolio.

How Do Life Events Influence Your Rebalancing Decisions?

Major life events should prompt a review of your asset mix. Events such as marriage, having children, a career change or retirement often change both your goals and risk tolerance. Where appropriate, adjust your target allocation — and your rebalancing cadence — to reflect those new priorities.

How Does Financial Planning Support Portfolio Rebalancing for Investors?

Financial planning provides the context for effective rebalancing. A comprehensive plan clarifies your goals, timeline and cash-flow needs so rebalancing decisions support your wider strategy rather than being treated in isolation.

What Role Does Risk Management Play in Rebalancing?

Risk management underpins rebalancing. Assessing the risk characteristics of each asset class helps you decide when and how to adjust allocations. A trusted adviser can identify emerging risks and recommend proportionate changes to protect the plan while keeping the opportunity for growth.

How Can Tailored Asset Allocation Strategies Benefit Different Investor Profiles?

Different investors need different mixes. Younger savers may favour higher equity exposure for growth, while those close to retirement often seek more defensive, income-focused assets. Tailoring allocation to individual profiles — and keeping it maintained through rebalancing — improves the likelihood of achieving each investor’s specific objectives.

Regular rebalancing is a practical tool to keep your investment strategy aligned with your financial plan and risk profile. Applied consistently and sensibly, it helps protect against unintended risk and supports steady progress towards long-term goals.

Frequently Asked Questions

What is the best frequency for rebalancing a portfolio?

There is no single “best” frequency. Many investors rebalance quarterly, semi‑annually or annually. Others prefer a threshold-based approach, acting only when allocations move materially from targets. The suitable choice balances transaction costs, tax impact and how closely you want to control risk. Pick the approach that fits your plan and stick to it.

How can I determine my target asset allocation?

Set your target allocation by considering your objectives, investment horizon and tolerance for volatility. Review your income, savings and planned withdrawals, and think about what level of short-term loss you can withstand. A risk questionnaire or a conversation with a financial planner can help translate these factors into a practical allocation.

What are the tax implications of portfolio rebalancing?

Rebalancing in taxable accounts can trigger capital gains tax when you sell appreciated assets. To reduce tax friction, consider rebalancing within tax-advantaged accounts where possible, use new contributions to rebalance, or employ tax‑loss harvesting to offset gains. A tax adviser can help you minimise the tax impact while keeping the portfolio aligned.

Can automated tools help with portfolio rebalancing?

Yes. Many platforms and robo-advisers offer automated rebalancing that follows your chosen rules. Automation removes emotional bias and saves time, but it’s still sensible to review the settings periodically to ensure they reflect any changes in your goals or circumstances.

What should I do if my portfolio is significantly out of balance?

If your portfolio has drifted materially from its targets, first quantify the drift and the reasons for it. Depending on the size of the gap, you might rebalance in stages to manage trading costs and tax, or make a single adjustment if appropriate. Ensure any action aligns with your long-term plan and consult an adviser if you’re unsure.

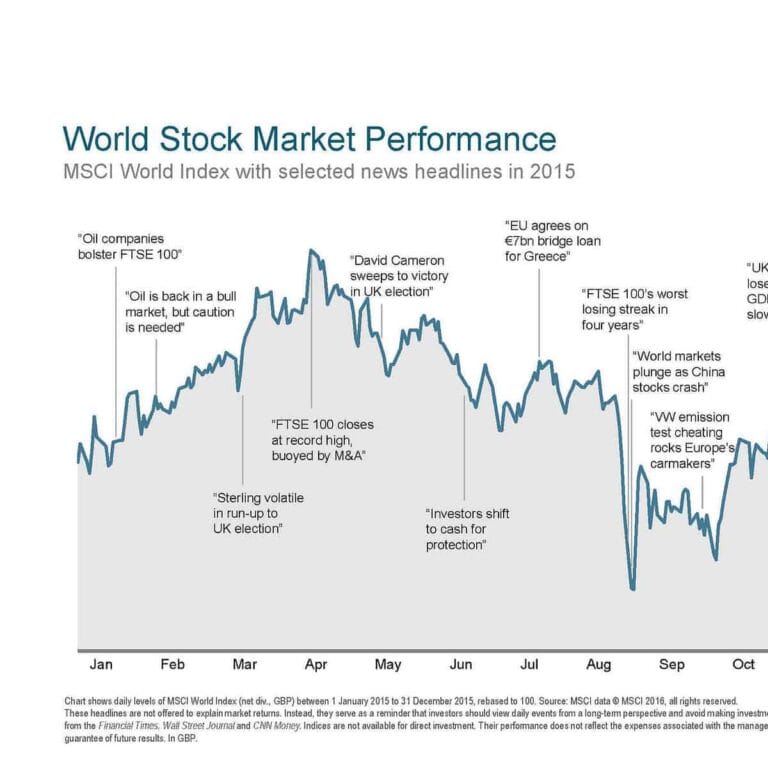

How does market volatility affect portfolio rebalancing decisions?

Volatile markets can create larger and faster allocation drift. While it can be tempting to delay rebalancing during turbulence, maintaining your chosen strategy usually prevents unwanted risk accumulation. Threshold-based rules can help avoid over-trading during short-term swings while ensuring you act when deviations become meaningful.